Example of TERS information required (TERS application)

- Mar

- 31

“Dear Employer

C19 TERS: Temporary Employee / Employer Relief Scheme

Please note the following:

Steps 1:

Key Documents required

- Letter of Authority, on an official company letterhead granting permission to an individual specified to lodge a claim on behalf of the company

- MOA (completion of the agreement between UIF, Bargaining Council and Employer); only applicable to employers that has more than 10 employees

- Prescribed template that will require critical information from the employer

- Evidence/payroll as proof of last three months employee(s) salary(ies)

- Confirmation of bank account details in the form of certified latest bank statement

All documents submitted will be subject to verification.

Step 2:

Submission Process

Submit/transmit all documents as required to UIF via dedicated mailbox

Covid19UIFclaims@labour.gov.za

Step 3:

Conclusion

Conclusion of the MOA between parties.

Payment will only be effected after MOA sign off between the Fund and the Employer/Bargaining Council.

Please complete attachment 6 if the payment must be paid to Employer/Bargaining council

Additional Information

- NMW that will be used to determine minimum payment to employees is as follows:

- Domestic: R124 .56 per day

- Agriculture: R149.44 per day

- EPWP: R91.36 per day

- Other Sectors: R166 .08 per day

- Opening of special account is only applicable to Bargaining council

- If you represent more than one employer, please submit one template per employer

- The means to payment is critical and provide banking details as per the mode selected, for example, if the payment should go to the employer, then the employer special banking account should be given.

- However, proof of payment is required to satisfy that the payments indeed went to the employees. This is also critical, if further payments are required.

- Please note the enquiry telephone to enquire on the claims lodged: 012 337 1997

- With reference to the prescribed template : Please note rules to executed

Payroll Companies: ( Use Attachment 1 and 2 )

- ##Filename should be in the following format

UIREEFERENCENUMBER_ddmmmyyyy_uniquesequence.csv

Example – 00000012_25mar2020_01.csv . unique sequence number can be a number which is not used to send file with same name – so when you send file first time uniquesequence can be 1, when sent second time it can be 2.

- File should start with a Header – H|DATE DDMMMYYYY

COLUMN HEADERS AS UNDER ARE NOT REQUIRED IN THE FILE. ITS JUST TO INDICATE SEQUENCING. REMOVE THE HEADER ONCE FILE IS GENERATED. ONLY H|DDMMMYYYY is required on the Top

UifReferenceNumber|Shutdown From (DD-MMM-YYYY)ONLY|Shutdown Till(DD-MMM-YYYY)ONLY|Trade Name|PAYE number|Contact Number|Email Address|IDNumber|First Name|LastName|Renumeration(Monthly)|Employment Start Date|Employment End Date|Sector Minimum wage per month|Leave Income(During Shutdown)|Bank Name|Branch Code|Account Type|Account Number

- The values of remuneration should not be comma-separated. Example – 26000.90 and not 26,000.92

- All the dates in CSV file should follow the date format DD-MMM-YYYY – Example – 23-APR-2020

- Sector Minimum wage per month value is Mandatory. A blank value will result in an error.

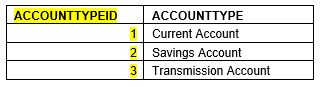

- Account Type value should reflect as below. Please use the Account Type ID instead of Account Type description.

- ## each file should have footer record as under

F|2050, HERE 2050 IS THE NUMBER OF EMPLOYEE RECORDS IN THE FILE

No payroll software. ( Use Attachment 3 )

This format is only for small employer who have no payroll software.

- The values of remuneration should not be comma-separated. Example – 26000.90 (Correct) and not 26,000.92

- All the dates in EXCEL file should follow the date format YYYY/MM/DD – Example – 2020/04/23

- Sector Minimum wage per month value is Mandatory. A blank value will result in error.

- Account Type value should reflect as below. Please use the Account Type ID instead of Account Type description. Use 1 for Current, 2 For Savings and 3 for Transmission Account

Unemployment Insurance Commissioner”

Attachments we received with this email from the Unemployment Insurance Commissioner, included the following:

2 payroll companies sample CSV FOR EMPLOYERS

3 National_Disaster_Payment-Excel_Template

Copy of Employers_Account_Information

MD’s email sent out for this post | https://bit.ly/2WQFrv3

LATEST RULES: Has Your Company closed due to Covid-19? Claim for your Employees now!

55 Responses so far.

Leave a Reply to Rebecca Cancel reply

This site uses Akismet to reduce spam. Learn how your comment data is processed.

Recent Posts

- PAYE Annual Reconciliation – Tax year 1 March 2023 – 29 February 2024 17/04/2024

- NOTICE TO ALL EMPLOYERS – W.As8 /Return of Earnings 2023 (February 2024 period) 16/04/2024

- Big change for employees earning over R21 197,64 30/03/2024

- Office Closure Friday 22nd March 19/03/2024

- Financial Sector Code – FSCA 19/03/2024

- CIPC cyber attack leaves millions of entities vulnerable across nation 12/03/2024

- WE ARE HIRING!!! 08/03/2024

- Our new electronic 2024/2025 tax guide 08/03/2024

- We are so proud of our recently qualified Chartered Accountants 08/03/2024

- #MDLadies | International Women’s Day 08/03/2024

- Happy International Women’s Day 08/03/2024

- 2024/2025 MD Tax Card 08/03/2024

- Congratulations Nicole and Brian on your wedding day! 05/03/2024

- 2023 Staff Awards 04/03/2024

- Kitchen Tea for Nicole 29/02/2024

- Budget Speech 2024 | How it affects you and your business 22/02/2024

- Congratulations to all of our Engaged MD Ladies 12/02/2024

- MD’s Top Tax Savings Tips ahead of the Budget on 21st February 2024 06/02/2024

- Maximise Your Remuneration Planning and Save Tax | MD’s Top Tax Savings Tips ahead of the Budget on 21st February 2024 05/02/2024

- Maximise Your Wealth Planning and Save Tax | MD’s Top Tax Savings Tips ahead of the Budget on 21st February 2024 05/02/2024

- Congratulations on your Engagement Saadiqah! 23/01/2024

- Congratulations on your Engagement Priyanka! 23/01/2024

- 2nd 2024 Provisional Tax Information Request 18/01/2024

- Congratulations on your Engagement Celine! 09/01/2024

- Congratulations Celine on completing your SAIPA Articles! 04/01/2024

- Annnnd, it’s a wrap! 22/12/2023

- Congratulations Memory on your Promotion! 18/12/2023

- Congratulations Nicole on Passing your SAIPA Board Exam! 15/12/2023

- Congratulations Kim on passing CTA! 13/12/2023

- MD’s 2023 year-end function! 08/12/2023

- Office Closure Dates and Season’s Greetings! 04/12/2023

- SARS change to Imports and new Advance Payment notification (APN) requirements from 1 December 2023 01/12/2023

I dont know which report to print from Pastel payroll to complete attachment 1 & 2, please advise which report…

Thanks

Due to the technical nature of your queries, please direct your question to the Department of Labour, which has a dedicated line to assist all employer/employees/Bargaining Councils on COVID19TERS. The contact number is 012 337 1997.

Hi Michelle,

Did you come right? Also confused?

Thank you for your message, but due to the technical nature of your query, please direct your question to the Department of Labour, which has a dedicated line to assist all employer/employees/Bargaining Councils on COVID19TERS. Their contact number is 012 337 1997.

Good Morning

When I save my information as CSV, some of my field formats change i.e. date format, contact number dropps”0″ and remuneration drops ‘.00″.

Do I have to submit information in column or in row format?

Thank you

Hi

Could be a setting on your computer, or you should call the call centre if a technical problem.

I do not have a payroll system and have downloaded the disaster relief template for Excel. Where do I put my employees information on this template?

Hi

Due to the technical nature of your queries, please direct your question to the Department of Labour, which has a dedicated line to assist all employer/employees/Bargaining Councils on COVID19TERS.

The contact number is 012 337 1997.

Good Afternoon,

Please could someone help us understand what we need to fill out in the XXXXX on the TERS MOA, we cannoy understand what info they are wanting is to fill in? With regards to Annexture A, do we need to complete this?

There are only 6 staff in our company.

Hi

We have found an alternative number for TERS – 0800 030 007

I have done all the .csv files but I don’t know what name to give the bank account details file?

Do you think if I attached 3 months payslips for my 3 employees that would be ok?

For the Bank details csv file I just used the same header as in the employee .csv file and made the footer F|1 because of one bank account. Wish they would have given us a sample of the bank .csv file

Hi

We have found an alternative number for TERS – 0800 030 007

Hi

I do have the payroll exported file in your above template, and also a file with the 3 months income for each employee, do I email both to Covid19UIFclaims@labour.gov.za and subject Covid19IIFclaims

Thanks

Hi

Please try the contact numbers provided above, or you can also email Covid19UIFclaims@labour.gov.za and UIF will feedback.

Where do I find the sector minimum wage amounts? We are in the Tourism industry.

National minimum wage that will be used to determine minimum payment to employees is as follows:

• Domestic: R124.56 per day

• Agriculture: R149.44 per day

• EPWP: R91.36 per day

• Other Sectors: R166.08 per day

Hi

You can also try an alternative number for TERS – 0800 030 007

Please advise what the format is for filling in the UIF reference number on the TERS employer registration page.

Hi

The UI number is the 8 digit number in the format ‘1234567/8’ and not the U-number with SARS on the EMP201.

Also having problems with the same thing. Did you come right eventually?

Hi

What exactly are you referring to here?

Thanks

What do we write on employment end date (do we leave it blank) and if no leave income is being paid do we wrote 0 or just leave column blank lastly the minimum wage can we use the minimum wage precribed by the bargaining council we fall under and so the minimum wage will differ per employee job title.

Hi

We can’t comment on clients/information we don’t have – each employer is different.

Please see email address and contact numbers provided above.

Hi. Trying to register , and it is not accepting my UIF Ref Number, it says invalid format. What format are we supposed to use?

Hi

The UI number is the 8 digit number in the format ‘1234567/8’ and not the U-number with SARS on the EMP201 or confirm the correct UIF number on https://uifecc.labour.gov.za/covid19/ under ”Get your UIF reference number”.

Please can you atlist send us sms for update since we have this promblem of not working as usually just for update ,we confused now because we come to labour standing out side with out any idea of how its work

Hi

TERS is an Employer-based claim system – please contact your employer directly or direct your queries to the Department of Labour/TERS call centre on 080 003 0007.

Hi,

With regards to payments made to the employees bank account , should the employer still attach company bank statement ?

Hi

The employer must provide confirmation of bank account details in the form of a certified latest bank statement.

What is the amount I should use for the salary, someone said I should say zero otherwise it will be declined. I have already input the actual monthly salary, can I fix it if it is wrong?

Hi

The “Remuneration” is the salary paid to the employee before lockdown while “Remuneration received during shutdown period” is the salary paid to the employee during lockdown.

Good day

In which format should the 4 Copy of Employers Account information excel spreadsheet be saved in to be emailed? CSV or do we email it in excel format?

The Copy of National Disaster payemtn Excel template ive saved and converted as explained in guidlines documents but im unsure how to save the Employers account information.

Hi

Please direct technical TERS related queries to their call centre on 012 337 1997 / 080 003 0007.

Queries can also be addressed to Covid19TersSupport@labour.gov.za if their call centre is unavailable.

Remuneration received during shutdown period (Column O).

Employee received nothing from employer while the lockdown so is it zero?? or they mean what they should receive from UIF for the lockdown period? very confused here.

Hi

The “Remuneration” is the salary paid by the employer to the employee before lockdown; “Remuneration received during shutdown period” is the actual salary paid by the employer to the employee during lockdown – if this is nil, then nil should be inserted under this column.

Hi

MY application was declined with the error message “ the Daily Salary amount is equal to or exceeds the UIF daily benefit”

ON the declined list there is an amount next to Monthly salary as well as an amount next to the Leave income. Might that be the problem for declining the payments.

Hi

Please re-submit your application to the Department of Labour.

Alternatively, please direct your queries to their call centre on 012 337 1997 / 080 003 0007.

Queries can also be addressed to Covid19TersSupport@labour.gov.za if their call centre is unavailable.

On the National Disaster Payment Excel Template there is column Sector Minimum wage per month*. Advertised minimum wage for Agri is R18/h, R149.44/day. What do i fill in here for Agriculture? Every month has a different number of working days. The Column isnt formatted for a Rand value as the Remuneration Monthly* column is. If not filled in correctly UIF just dump it. please help with format and content for this column.

Hi

TERS/UIF will default the minimum wage to R3 500.00 per month if you do not insert your own value.

Please direct your queries to the Department of Labour/TERS call centre on 080 003 0007.

Queries can also be addressed to Covid19TersSupport@labour.gov.za if their call centre is unavailable.

Hi our application was approved but was told to send UIF employees declarations, 3 months payroll schedules i did and UI19 , still payment was not done . How long does it take for them to audit after sending all information to compliance?

Hi

Please direct your technical queries to the Department of Labour/TERS call centre on 080 003 0007.

Queries can also be addressed to Covid19TersSupport@labour.gov.za if their call centre is unavailable.

Good Morning

We have the following declined payment error:

Error Desc:

But no reason is provided.

The other error message is ID not found.

How do we rectify this?

Hi

Please direct your technical queries to the Department of Labour/TERS call centre on 080 003 0007.

Queries can also be addressed to Covid19TersSupport@labour.gov.za if their call centre is unavailable.

Hi

If i go to payment breakdown, and choose “Declined Payment”, i get the following under the employee:

Error Desc: Application not processed yet

Can i resubmit the csv file again or do i need to wait

UiF number: 2594793/1

Thankyou

Hi

Please contact TERS office for rejection reason – Department of Labour/TERS call centre on 080 003 0007.

Queries can also be addressed to Covid19TersSupport@labour.gov.za if their call centre is unavailable.

Have no received salary or we have to wait for our yif

Hi

You would need to contact the Department of Labour directly on 0800 843 843 or 012 337 1680 for further assistance in this regard.

I have error on my TERS application online say in Incorrect banking details. What must I do as the companies bank details is on the online portal.

Hi

Please direct your technical queries to the Department of Labour/TERS call centre on 080 003 0007. Queries can also be addressed to Covid19TersSupport@labour.gov.za if their call centre is unavailable.

Error made when applying for May . Leave income should be 0 I filled in the remuneration. How do I fix this as no remuneration was paid during this time .

Hi

You can change TERS submission if not paid out yet – Go to Saved Employees and Edit option to change/Delete employee and re-create and then re-submit the application.

Hi I applied on behalf of the company employees during the first week of May 2020 but up to now there is no one in my company has been paid, the report came back listing employees that are processed and employees that are declined but those employees are all foreigners, South Africans do not appear in any of the reports I have been phoning everyday but no one seems to know what is happening.

Hi

Please direct your technical queries to the Department of Labour/TERS call centre on 080 003 0007 – they would be able to address your queries relating to the rejections.

Queries can also be addressed to Covid19TersSupport@labour.gov.za if their call centre is unavailable.

Good day

I must have made a mistake when I captured the creches trade name. How do I rectify the trade name please? The name is correct it is just that there are a letter where it is not suppose to be.

Hi

Please direct your technical queries to the Department of Labour/TERS call centre on 080 003 0007.